By Drew Hefflefinger, CFP®

THE WHY behind student loans. This post will discuss how law school, and thus student loans, are a means of increasing human capital, how that capital may be used today, and offer insight into what the future may bring.

Student loans are a part of nearly every lawyer’s life — you may be on track to the lifestyle you dreamed of in law school, but debt is a constant pull on the monthly budget. It is okay… in most circumstances you made a great long-term investment.

My girlfriend is a lawyer; while in school she spent sleepless nights reading, outlining, writing memos, preparing briefs, and drinking way too much coffee! What she was doing in economics terms was increasing her human capital, or her ability to earn and save into the future. This type of capital can be increased via ability, experience, and you guessed it… education. So was the debt, money, and time out of the marketplace worth the cost?

Research from the U.S. Bureau of Labor Statistics indicates that the average earnings of a Bachelor’s Degree holder is $57,252 vs. the Advanced Degree holder (J.D. included) of $72,072, that is an immediate difference of $14,820 per year! Although you may be burdened by debt at the moment, the idea is those loans will not be a part of your life forever and greater financial flexibility is to come. So yes, as long as there is a well-defined path to being student loan debt free it appears you made an excellent choice.

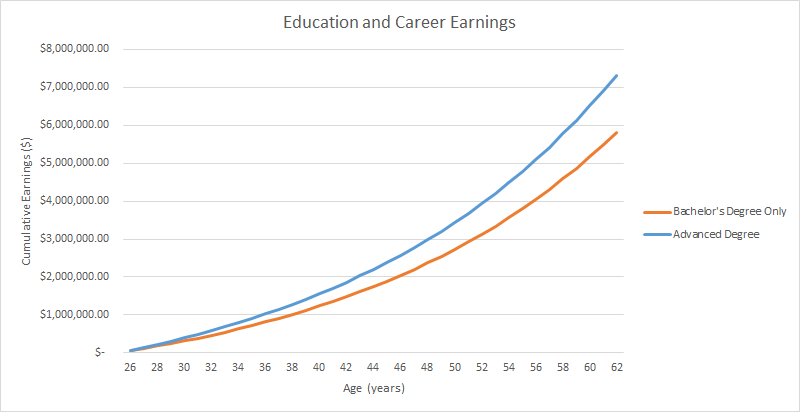

When looking at the long-term effects the results are even more encouraging. In the chart above we can see what happens when you add up the cumulative earnings over an entire career. At the end of this example, 62 years old, the Advanced degree holder has earned $1,506,129 more than the Bachelor Degree holder! That additional lifetime income is going to go a long way when you start planning for many of life’s major events including your first home, sending your children to college, and especially your own retirement goals.

So as debt may be a part of many of our lives today it is important to understand why we took the debt in the first place. You made an investment in yourself — and like many investments in this world they take time and patience in order to realize their true return.

In my interactions with attorneys the number one financial concern I hear is, “I need help making sense of my student loans”. The next post I will get more technical and discuss the pros and cons of private refinancing of Federal Loans.

Drew Hefflefinger is a CERTIFIED FINANCIAL PLANNER™ at Private Client Wealth Advisors, LLC in Denver, Colorado. Drew specializes in working with young attorneys by helping them make smart and informed decisions with their money. Drew can be contacted at drew@pc-wa.com.

Leave A Comment